We are always looking to make sure our loved ones are taken care of and to uplift the causes we care about. There is a donor strategy that does both.

When you make a gift of $10,000 or more in the form of a charitable gift annuity in cash or stocks, you can secure a reliable future income for you or someone you love while supporting Embry-Riddle. As an irrevocable agreement, this type of donation is backed by the assets of Embry-Riddle Aeronautical University. The benefits include that a portion of your charitable gift annuity is immediately tax-deductible if you itemize your tax return. Additionally, a portion of your annuity payment is tax-free during normal life expectancy.

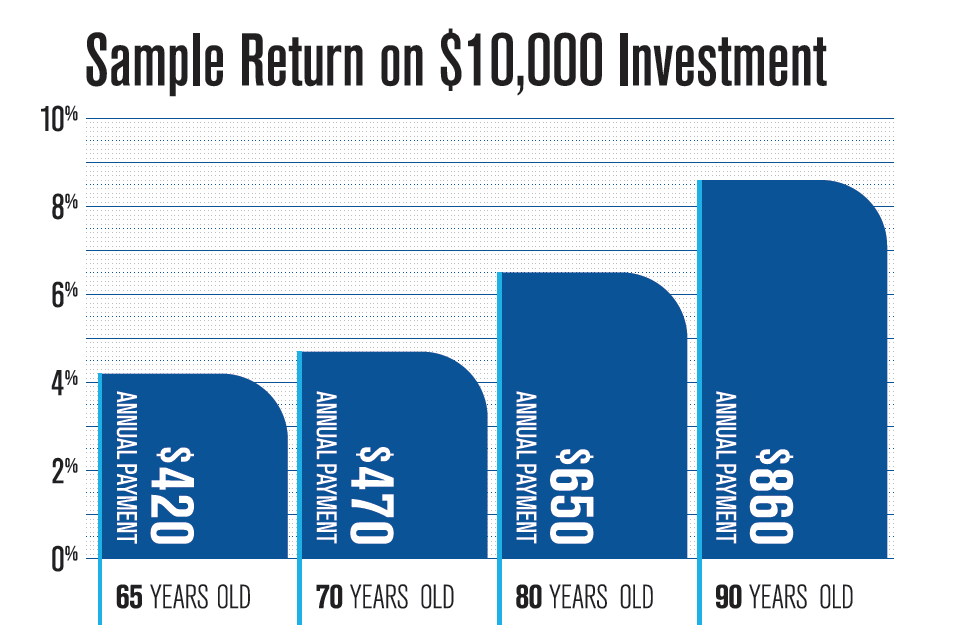

The payment amount is based on the amount of the gift and the age of the person receiving the annuity. You can request a single-life or a double-life charitable gift annuity with rates consistent with the American Council on Gift Annuities’ recommendations.

To learn more about charitable gift annuities and get a free no-obligation quote, contact me at 386.226.7568 or email travis.grantham@erau.edu

Travis Grantham

Executive Director, Gift Planning and Special Gifts